The London based prop trading firm Funded Trading Plus is best known for its trader friendly programs and massive discounts it offers to its traders. Since Funded Trading Plus began operations in 2021, a number of traders have shown blind faith in the firm; these traders have since proven themselves to be some of the most experienced and successful prop traders. Many of those who I know are now regarded to be among the most well-known trade influencers on social media.

However, I don’t try to blindly trust prop firms or just grab hold of appealing offers; instead, I try to put myself to the test and then base my decisions on my own trading experience.

- Multiple funding programs are available to cover all types of traders, from beginners to professionals.

- Offers all type of trading instruments

- No Minimum & Maximum Trading Day

- Trader friendly scaling plan up to $2,500,000

- Payouts are withdrawable every week

- Allows weekend holding, overnight holding, and news trading

- Allows hedging on the same account.

- All funding programs come with a trailing drawdown

- The maximum leverage offered on all funding programs is capped at 1:30

- Drawdown issues have been reported by some traders on the community

- The Advanced Trader Program requires a mandatory stop-loss

- Weekend holding is not allowed on the Master Trader and Advanced Programs

- As account size increases, the profit share reduces

Hi! This is Dominic Merrick, a trader and analyst at Forex Trading Journals. As you read along, you’ll discover my trading experience with Funded Trading Plus, the merits and demerits I encountered along the way, and whether I was able to make any profit trading with Funded Trading Plus, and if so, how!

First, it’s important to know the basics of the firm, such as the physical office location, jurisdiction of formation, and registration. Before I guide you in sharing my experience in detail, let’s look at those primary pieces of information.

Company Overview

| 💼 Business Name | Funded Trading Plus, LLC |

| 👨✈️ CEO | Simon Massey |

| 📆 Year Founded | 2021 |

| ⚓ HQ | UK |

| 🚩 Address | 7 Bell Yard, London, WC2A 2JR |

| ® Company Number | 13719292 |

| 📅 Company Incorporated on | November 02, 2021 |

| 🔢 UK VAT Number | 413867388 |

| 🔻 Maximum Daily loss | Experienced Trader Programs 4% Advanced Trader Programs 5% Premium Trader Programs 4% Master Trader Programs 6% |

| ⛔ Maximum Loss | Experienced Trader Programs 6% Advanced Trader Programs 10% Master Trader Programs 6% Premium Trader Programs 8% |

| 🔀 Profit shares | Up to 90% |

| 📧 Contact Email | info@fundedtradingplus.com |

Funded Trading Plus Faces

Funded Trading Plus – Prop Trading Overview

| 👮 Liquidity Provider | ThinkMarkets |

| 💲 Minimum Deposit | $119 |

| 💰 Account Currencies | USD, GBP, and EUR |

| 🏦 Funding Models | One Phase Evaluation Two Phase Premium Evaluation Two Phase Advance Evaluation Instant Funding Master |

| 💸 Scale Up Plan | Up to $2.5 Million |

| 💻 Trading Platforms | Match-Trader; DXTrade |

| 🛠 Instruments | 55 Forex, 17 Commodities, 19 Indices and 125 Cryptos |

| ⚖ Leverage | 30:1 |

| 🕛 Evaluation period | Unlimited |

| 🥂 Profit Share | Min. 80:20 Max. 90:10 |

| 🎮 Free Trial | Unavailable |

| 📲 Mobile App | Unavailable |

| ☎ Support | 24/7 |

| 🔥 Coupons | 10% |

Now that you know what type of firm Funded Trading Plus is, let’s delve into how my journey went with their funded account.

First off, let’s explore the types of funded programs they offer and how my funded account progressed through each phase.

Funded Trading Plus Account Types and Fees

Funded Trading Plus has been quite synonymous with affordability in terms of fees and the programs they have been offering have a market weight that a much more convenient to perform. This truly allured me to trade with their funded account. It is important to note that no prop firm provides a real fund but rather a simulated fund. This has been the scenario since the MyForexFunds case last year.

However, let’s get back to my journey, Funded Trading Plus in these way wasn’t unfamiliar to me, so I was quite interested to know how I performed with all their condition, limitation or rather restrictions.

To test them better or go deep to their roots as a fund provider, I believe it was important to use a two phase evaluation. So, I chose the Two-Phase Premium $50,000 Account. Although it cost me $397, the terms or the given conditions associated with it were really interesting. I got unlimited days to trade in each phase. Phase 1 profit target was 8%, which in $50,000 is $4,000. Besides, there were no minimum days to trade, loss limit was $2,000, or rather, 4% of the actual fund.

Although the funded trader claim that they support EAs, I found that it is not supported in their trading platforms(DX Trade and Match-Trader). The weekend holding was also allowed in my Premium Evaluation, but if you trade one phase Experienced or two phase Advance evaluation, you mayn’t get this opportunity and close trade within Friday afternoon. The Phase 1 seemed very achievable to me. I could hit $4,015 within 13 days of my trading.

Nevertheless, let’s talk about the rough patches. My biggest drawdown during this phase was $768. Why bring up the losses? Because trading isn’t sunshine and rainbows. It’s a mental game as much as anything, and you’ll take hits alongside the wins. The key is having a solid risk management plan in place to minimize those losses. Even the best trades can go south in this volatile market, so even a well-organized plan might see a loss here and there.

Phase 2 of the evaluation was quite relaxed compared to the toiling part of Phase 1. The profit target was set at 5%, while everything else remains the same. Since I’d already planned a risk management strategy for this purpose, I really achieved the target with the minimum damage. I could pass my entire evaluation within 23 days in total, although there was no time limit.

The funded phase was initiated soon after I passed the 2nd phase of the evaluation. Since I was trading actively and confidently, the changes to the new trading environment was seamless. Now, you might be wondering why I’m mentioning the trading environment instead of the rules. Here’s the kicker: there’s practically no difference in trading conditions between the evaluation, funded phase, and becoming a full-fledged FT+ Trader.

The funded phase wasn’t about chasing a profit target anymore, but keeping a sharp eye on losses—that was the only rule I truly had to focus on. The key rule transformed from “reach X amount of profit” to “don’t exceed the loss limit.” This shift in focus allowed me to refine my approach, prioritizing calculated trades and minimizing potential losses. It felt empowering to trade with the security of a funded account while honing my skills in a familiar environment.

My Funded Trading Plus Evaluation Phase Objectives (Premium: $50,000)

| Features | Phase 1 | Phase 2 | Instant Funding |

|---|---|---|---|

| Profit Target | 10% for One/Single Phase Evaluation Rest 8% (For my account $4,000) | 5% ($2,500) | Not Applicable |

| Minimum Trading Days | 1 in 30-day cycle | 1 in 30-day cycle | No Minimum Trading Days |

| Maximum Trading Days | Unlimited | Unlimited | None |

| Maximum Daily Loss | 4% ($2,000) | 4% ($2,000) | 6% ($1,500) |

| Overall Drawdown | 8% ($4,000) | 8% ($4,000) | 6% ($1,500) |

| EAs | Currently, Funded Trading Plus’s DXtrade platform does not support the use of Expert Advisors (EAs) or automated trading bots. This functionality is not available at this time, but the platform may be updated to include EA compatibility in the future. *If your strategy relies on EAs, consider exploring other prop firms like Surge Trader or E8 Funding, which offer full EA compatibility. | ||

| Copy Trading | Funded Trading Plus prohibits any form of copy trading across multiple FT+ accounts. This includes mirroring positions (opening identical trades on the same market at the same time) or time-based matching (opening/closing trades based on another account’s timing). However, one can copy trade from one of their personal accounts to a single FT+ account. The key takeaway is that each FT+ account should represent a unique trading strategy. Their systems monitor for activity suggestive of copy trading, and violations may result in nullified profits according to the Terms and Conditions. Remember, one can only have one live FT+ account per strategy. | ||

| Refundable fees (Minimum) | One Phase Evaluation: $119 (funds: $12,500) Two Phase Premium Evaluation: $247 (funds: $25,000) Two Phase Advance Evaluation: $199 (funds: $25,000) Instant Funding Master: $225 (funds: $5,000) | ||

What are the Funded Trading Plus Tradable Instruments and Spreads?

I found a wide range of tradable instruments available on Funded Trading Plus.

They have a wide range of cross an minor pairs in addition to more than 50 forex currencies, including all major and exotic pairs.

In addition to forex, they provide access to popular indices from around the world. This includes well-known names like the SPAIN35, SPX500, VIX, TAIEX, HK50, and CHINA50, alongside names like US30 (Dow Jones Industrial Average), UK100 (FTSE 100), GER40 (DAX 30), NAS100 (Nasdaq 100), JPN225 (Nikkei 225), FRA40 (CAC 40), and US2000 (Russell 2000).

Funded Trading Plus covers more than just forex and indices. The exciting part is that they have access to 17 different assets for commodity traders, which include precious metals like gold and silver to the highly volatile oil markets. Still, that’s not all! Do you have a passion for cryptocurrencies or are you just starting to explore the fascinating world of digital assets? Additionally, a large offering of 125 cryptocurrency pairs is covered by Funded Trading Plus. In order to diversify your portfolio, you can trade well-known cryptocurrencies like Bitcoin and Ethereum or discover lesser-known altcoins. This diverse range of instruments allows traders to explore various market opportunities and tailor their strategies accordingly.

Now, the spread on the offered instruments depends on their fund provider. During my research phase about Funded Trading Plus, I really wanted to find out the spread, like I always do for any prop trading firm or broker. I checked the spread using the following user and pass from the platform they offer.

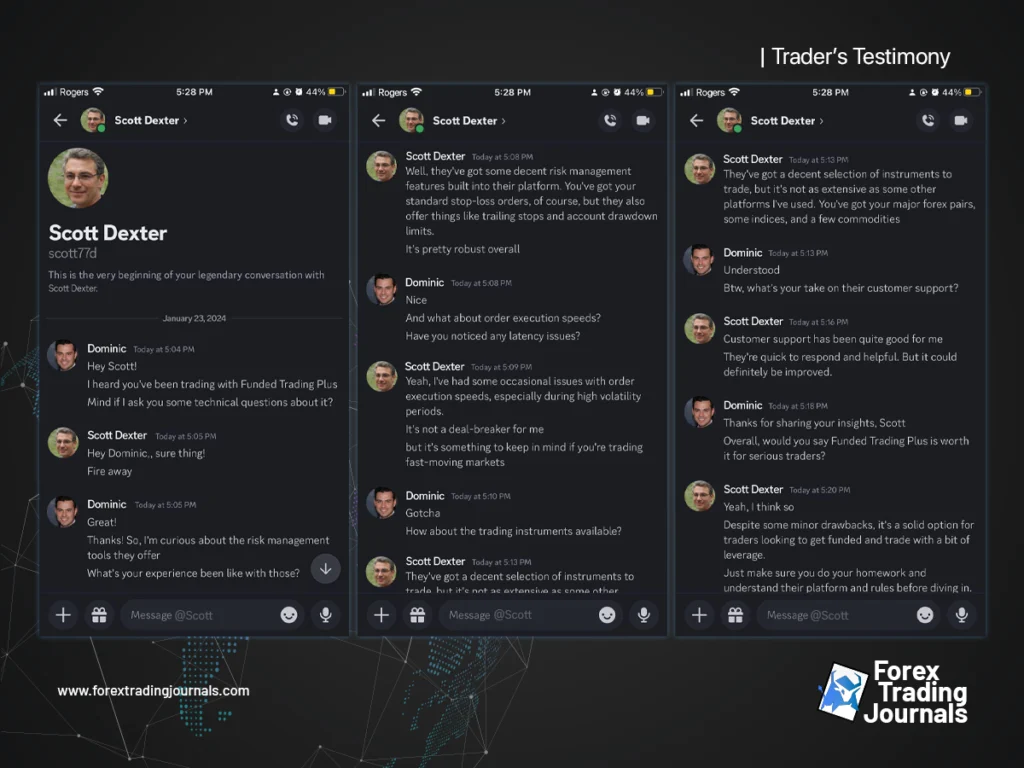

Reputation and Funded Trading Plus Reviews

It’s natural for people to seek out others’ experiences before making decisions, which is likely why you’re here now, right? Similarly, when I couldn’t find compelling information about trading with Funded Trading Plus online, I searched extensively for insights or experiences from others—anything to convince me it wasn’t just smoke and mirrors. My search led me to two traders in different online communities: Terry Renker and Scott Dexter. They both had experience trading with Funded Trading Plus’ fund. Understandably, mere words may not be convincing enough, so I’m sharing screenshots of my conversations with both of them.

FTP Dashboard Tour

The web dashboard of Funded Trading Plus is refreshingly simple yet incredibly useful. While it may not boast the flashy design of some other prop firms, it’s got all the essentials right there on the dashboard page.

Once you log in, you’re greeted with a comprehensive overview of your account and trades. You can easily navigate to check your trade history, review notifications, and brush up on the trading rules and definitions. This setup ensures that traders like myself don’t feel overwhelmed or lost in the midst of trading and can operate sensibly within the established rules.

What I really appreciate is that everything related to my account is neatly organized on the dashboard homepage. This user interface setup saves me from the hassle of searching for different pieces of information scattered across multiple pages. It’s a straightforward and efficient way to manage my trading activities.

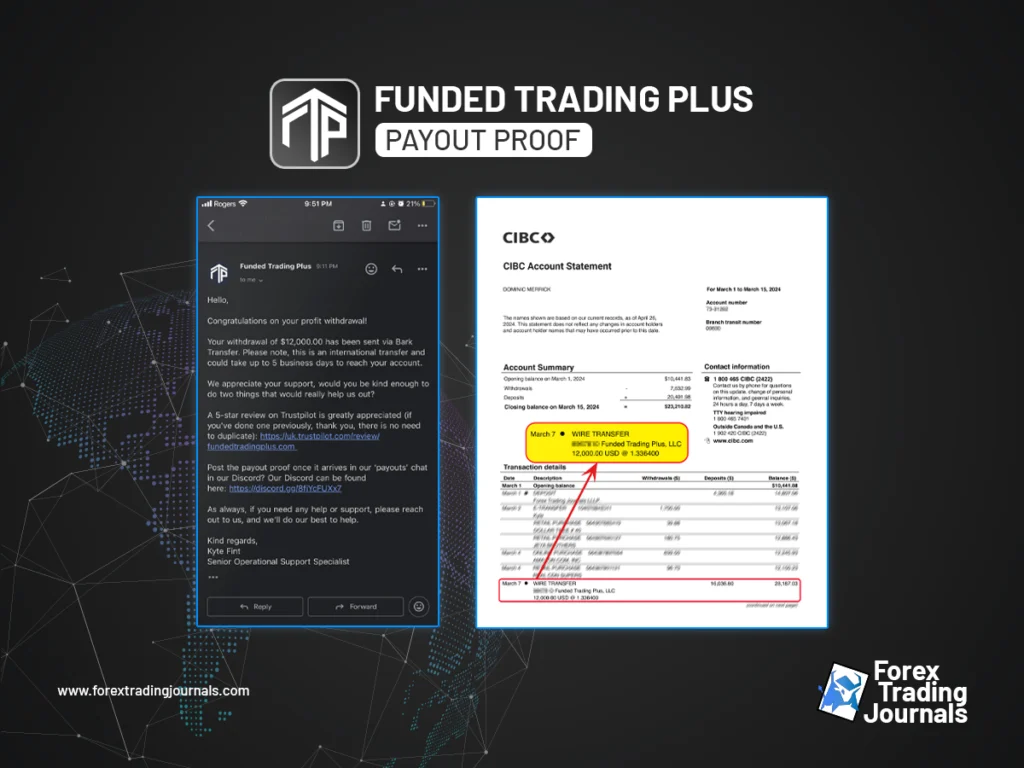

Funded Trading Plus Payout Proof and Profit Split

As a forex trader, I place great importance on consistent and dependable payout systems. Funded Trading Plus has truly impressed me in this aspect.Their profit-sharing model, where traders keep 80% of their earned profits, is clear and straightforward. I can vouch for its reliability from my own experience. After making $15,000.70 in profits, I received a prompt payout of $12,000.00 within the first week of the following month. This smooth and hassle-free payout process has greatly boosted my trust in Funded Trading Plus as a prop firm partner.

Funded Trading Plus Education, Tools, and Application

Funded Trading Plus doesn’t offer a ton of bells and whistles when it comes to education. While they have some blog posts, they don’t seem to be updated very frequently. If you’re a beginner looking for in-depth educational content, you might want to consider other options.

Another drawback is the lack of a mobile app. While some traders prefer the flexibility of a mobile platform, it’s not available here. Just something to keep in mind if you like to monitor your trades on the go.

Funded Trading Plus Trustpilot

Before diving in, I did my research, and Trustpilot was my go-to platform for all things Funded Trading Plus. I scoured through reviews, both positive and negative, to get a well-rounded picture. Honestly, Funded Trading Plus’ 4.8-star rating with so many satisfied traders was impressive. But to address any concerns, I reached out to their live support regarding some of the negative Trustpilot reviews. I was impressed by their responsiveness and how they addressed those issues in a reasonable and transparent manner. Overall, the positive reviews on Trustpilot, combined with their proactive support team, gave me the confidence to explore Funded Trading Plus further.

Funded Trading Plus Alternatives

Funded Trading Plus impressed me as a fund provider! They offer a lot, including tons of resources, fantastic customer support, and reasonable account sizes that make trading a breeze. But the competition is heating up! Every other prop firm seems to be luring traders in with sweet deals; some even mention “real profit dynamics,” which piques my interest.

My research keeps pointing me towards E8 Funding, SurgeTrader, and The5ers. Maybe we should check them out before fully committing to Funded Trading Plus. Comparing options is always smart, right? That way, we can find the prop firm that perfectly aligns with both our goals and trading style.

| Features | Funded Trading Plus | Surgetrader | E8 Markets | The5ers |

|---|---|---|---|---|

| Account Types | 3 types of account Experienced Trader Programs: One Step Evaluation; Advanced Trader Programs: Two Step Evaluation; Premium Trader Programs: Two Step Evaluation ; Master Trader Programs: Instant Fund | 3 types of account One Step Evaluation; Two Step Evaluation; Lightning (Instant Funding) | 3 types of account Pro Account – One Step Evaluation; E8 Account – Two Step Evaluation; Track Account – Three Step Evaluation | 3 types of account Hyper Growth – One Step Evaluation; High Stakes – Two Step Evaluation; Bootcamp – Low Cost Program |

| Profit Target | 10% for One/Single Phase Evaluation Rest 8% (For my account $4,000) Second Phase: 5% | One Step: 10% Two Steps: Phase 1: 8% Phase 2: 5% Lightning: 5% | Pro Account – 8%; E8 Account – Phase 1: 8% Phase 2: 4% Track Account – Phase 1: 8% Phase 2: 4% Phase 3: 4% | Hyper Growth – 10%; High Stakes – Phase 1: 8% Phase 2: 5% High Stakes Trader: 10%; Bootcamp – Phase 1: 6% Phase 2: 6% Phase 3: 6% |

| Maximum daily loss | Experienced Trader Programs : 4%; Advanced Trader Programs : 5%; Premium Trader Programs : 4% ; Master Trader Programs : 6%; | One Step: 5% Two Steps: Phase 1: 5% Phase 2: 5% Lightning: 3% | Pro Account – 2%; E8 Account – Phase 1: 8% Phase 2: 4% Track Account – Phase 1: 8% Phase 2: 4% Phase 3: 4% | Hyper Growth – 3% ; High Stakes: Phase 1: 5%; Phase 2: 5%; High Stakes Trader: 5%; Bootcamp: Phase 1: NA; Phase 2: NA; Phase 3: NA; High Stakes Trader: 3%; |

| Overall Loss | Experienced Trader Programs : 6%; Advanced Trader Programs : 10%; Premium Trader Programs : 8% ; Master Trader Programs : 6%; | One Step: 8% Two Steps: Phase 1: 8% Phase 2: 8% Lightning: 4% | Pro Account – 8%; E8 Account – Phase 1: 8% Phase 2: 4% Track Account – Phase 1: 8% Phase 2: 4% Phase 3: 4% | Hyper Growth – 6% ; High Stakes – Phase 1: 10% Phase 2: 10% High Stakes Trader: 10%; Bootcamp – Phase 1: 5% Phase 2: 5% Phase 3: 5% |

| Minimum trading days | No Minimum | One Step: No Minimum Two Steps: Phase 1: No Minimum Phase 2: No Minimum Lightning: 7(Min & Max) | No Minimum | Hyper Growth – NA; High Stakes – NA Bootcamp – ; NA |

| Leverage | 30:1 | One Step- 20:1 Two Steps: Phase 1- 50:1 Phase 2- 50:1 Lightning: 20:1 | Forex 1:50 Indices: 1:25 metals 1:25 Crypto 1:2 | Hyper Growth – 1:30 ; High Stakes – Phase 1- 1:100 Phase 2- 1:100 High Stakes Trader- 1:100; Bootcamp – Phase 1- 1:10 Phase 2- 1:10 Phase 3- 1:10 |

| Profit Split | Regular : 80/20; 20% of simulated profit: 90/10 30% of simulated profit: 100/0 | 90% | 80% | 90% |

| Account Opening Fees (Minimum) | $119 – Funds $12,500 (Experienced Trader Programs) | $138(E8 Track) $228(E8 Account-$25,000 Fund) | $50 (2 Step-Normal, 1 Step) Funds $5,000 | $49 (Evaluation Fund $6,000) |

| Account Opening Fees (Maximum) | $4,500 – Funds $100,000 (Master Trader Programs) | $988 (Funds $200,000) | $1600 (2 Step-Pro) Funds 300,000 | $1099 (Swap Free Account, Funds $200,000) |

| Forex Trading Journals Discount | Available↗ | Available↗ | Not Available | Available |

| EA Trading | Allowed with Conditions | Allowed with Conditions | Not Allowed | Allowed with Conditions |

| Trade Copier | Not Allowed | Allowed with Conditions | Allowed | Allowed with Conditions |

| Weekend Holding | Allowed | Allowed with Conditions | Allowed | Allowed |

| News Trading | Allowed | Allowed with Conditions | Pro Account: Allowed E8 Account: Not Allowed Track Account: Not Allowed | Allowed on High Impact News |

| Commission | $7 per lot on all FX pairs, and additionally Gold, Silver & Gold/EURO | N/A | N/A | $4/Lot |

| Trading Blogs | Available | Available | Available | Available |

| Educational Contents | Available | Available | Available | Available |

FTP Potential Areas of Improvement

Here’s my take on Funded Trading Plus, with a focus on areas they could improve:

Educational Resources

Overall, my experience with Funded Trading Plus has been positive, yet I wish they offered more educational opportunities. The blog posts are functional, but they could be much better with regular updates and broader content. I’m a trader who is constantly trying to learn and get better, so having access to some new educational materials would be great.

Leverage Limitations

To be honest, the 1:30 leverage seems a little tight, especially for traders with experience like me. Although I recognize the value of risk management, it would be nice to have the choice of greater leverage. Naturally, this would be accompanied by appropriate risk management plans.

Website and Dashboard UI

The website and trader dashboard could definitely benefit from a refresh. Right now, it feels a little cluttered and not the most intuitive. A cleaner design would make it easier to find the information I need quickly. Imagine being able to navigate to key features and data points in a snap – that would be a game-changer!

Funded Trading Plus Discord

Getting into the Funded Trading Plus Discord seemed comparable to entering a crowded marketplace. Traders from all kinds were exchanging practices, exchanging ideas, and even offering each other assistance for losses (we’ve all been there!).

There’s always a lot going on the Discord server, which is great for monitoring sentiment in the market and determining the overall perspective of traders. Funded Trading Plus has also carefully arranged the system, allocating specific channels for certain subjects like General chat, Trading chat, and Payout proof. This facilitates navigation and maintains everything in order on the server. The most beneficial feature would be the encouraging mentoring that permeates the server. Expert traders are a treasure trove of information for anyone seeking to improve their abilities, as they are frequently eager to share their expertise and respond to inquiries.

Join Funded Trading Plus Discord

Is Funded Trading Plus Legit or Scam?

My experience confirms that Funded Trading Plus is a legitimate prop firm. Although there’s been a lot of talk lately about Funded Trading Plus, and for good reason, I wanted to sort through everything as a trader to determine whether this prop firm is truly trustworthy or just another online scam. I hope this summary of my experience may assist you in making a wise choice.

I place a lot of importance on transparency, and Funded Trading Plus looks to deliver on that front. Their terms and conditions are easily accessible and understandable. From the beginning, you are well aware of what you are getting into: the profit-sharing system is clear, and the challenges that you must overcome in order to obtain a funded account are precisely laid out. On my end, there haven’t been any unexpected surprises.

The evaluation process itself was difficult but reasonable. They have very specific guidelines in place, and you have a good chance of getting funded if you play by them and use solid risk management. I received the payout in the timeframe they stated.

Finally, It’s up to you to decide in the end. Research other prop firms, consider the benefits and drawbacks, and determine whether Funded Trading Plus fits your particular trading objectives and degree of competence.

Frequently Asked Questions (FAQ)

Do Funded Trading Plus have any minimum and maximum trading days?

Funded Trading Plus doesn’t have any time constrains as such, they only check if you’re active on the platform. That’s why they check if you’re trading at least once in a month.

Who are the liquidity providers for Funded Trading Plus?

Think Markets is the liquidity provider for Funded Trading Plus.

Does Funded Trading Plus ask for any trading commissions? If yes, then how much is that?

Funded Trading Plus doesn’t charge any additional trading commissions on top of the fees set by their liquidity provider, ThinkMarkets.

ThinkMarkets charges commissions on specific instruments:

$7 per lot on all FX pairs

Gold, Silver & Gold/EURO (commission rates not explicitly mentioned here, so you might need to check ThinkMarkets’ website for details)

It’s important to note that you’ll also incur swap fees for holding positions overnight. You can find these swap rates directly on the Funded Trading Plus platform for each instrument.

Can I trade in MT4, MT5 with Funded Trading Plus?

You won’t be able to use MT4 or MT5 with Funded Trading Plus currently. Due to a recent change by MetaQuotes, the developer of these platforms, they are no longer available for prop firms.

However, Funded Trading Plus offers alternative trading platforms that you can use: DX Trade, cTrader, and Match Trader. These platforms should allow you to trade the instruments you’re interested in.

Here’s a quick comparison to help you decide:

DX Trade: Might be a good choice if you’re familiar with a user-friendly interface.

cTrader: Offers advanced charting and order types, ideal for more experienced traders.

Match Trader: Could be a suitable option if you prioritize speed and order execution.

It’s recommended to explore these platforms and see which one best suits your trading style and preferences.