Most traders focus on strategies, indicators, and chart patterns but overlook the one habit that ties everything together: using a trading journal. A trading journal transforms your trading from random decisions into a structured, measurable, and repeatable process. It’s like an athlete reviewing game footage. When you journal your trades, you see what went right, what went wrong, and how to improve next time.

Many traders struggle not because they lack skill but because they lack data, self-awareness, and honesty about their decisions. A trading journal gives you clarity, removes emotional fog, and helps you make smarter decisions based on facts, not feelings.

What Is a Trading Journal?

A trading journal is a structured record of all your trades, including entry/exit details, emotions, market conditions, mistakes, and lessons. It acts as a personal trade tracker that helps traders analyze performance, refine strategies, and strengthen discipline. A good trade journal shows patterns in your behavior and results so you can trade with confidence and consistency.

Key Benefits of Journaling Your Trades

- Accurate performance tracking for traders

- Better understanding of strengths and weaknesses

- Improved trading psychology and emotional control

- Faster strategy refinement and optimization

- Builds profitable trader habits

- Reduces impulsive decisions and overtrading

- Supports long-term trading discipline and consistency

Why Traders Should Journal Their Trades?

1. Track Performance With Clarity

Without a trading journal, you’re trading in the dark. You might have a good week or a bad week, but you don’t truly know why.

A journal helps you:

- Track your win rate

- Identify your best setups

- See what time of day you trade best

- Analyze risk-to-reward patterns

- Spot recurring mistakes

When you track your trades, you start making decisions based on real data and trading metrics, not guesses.

2. Identify Strengths and Weaknesses

Every trader has strengths. Maybe you’re great at trend continuation trades. Maybe you perform well in high-volume sessions.

A trading journal makes these patterns obvious.

Likewise, it reveals weaknesses:

- Overleveraging

- Moving stop-losses

- Exiting too early

- Taking low-quality setups

Crucially, the journal doesn’t judge you; it simply reflects your behavior back at you. That’s how growth begins.

3. Improve Trading Psychology and Emotional Control

Trading psychology plays a huge role in success. Fear, greed, revenge trading, and FOMO can destroy a profitable edge.

When you journal:

- You acknowledge emotional triggers

- You recognize stressful situations

- You see which emotions lead to losses

- You reduce impulsive decisions

This is why the benefits of journaling trades go beyond charts. It’s a tool to understand yourself.

4. Build Consistency Through Reflection

Consistency isn’t about winning every trade it’s about following your rules every time.

A journal helps you check:

- Did I follow my strategy?

- Did I stick to risk management?

- Did I take only valid setups?

This creates profitable trader habits that compound over time.

5. Adapt and Refine Your Strategy

Markets change. Strategies evolve.

A trading journal lets you evaluate:

- Which strategies still work

- Which need adjustment

- Which should be removed entirely

This is how you continuously improve and maintain an edge.

The Career Value of Journaling

1. Journaling Makes You a Professional

Professional traders from hedge funds to prop firms review their trades daily.

Why?

Because professionalism means:

- Documenting what you did

- Knowing why you did it

- Learning from every outcome

Using a trade journal shifts your mindset from “random retail trader” to “disciplined operator.”

2. Supports Continuous Learning

Markets are classrooms. Your journal is your notebook.

Through consistent journaling, you:

- Understand market behavior

- Recognize recurring patterns

- Learn faster from mistakes

Most traders repeat the same mistakes because they never document them. Journaling stops that cycle.

3. Improves Risk Management for Traders

Risk management is the foundation of longevity.

Your journal highlights:

- Risk per trade

- Drawdown periods

- Risk-to-reward ratios

- How your risk choices affect performance

This is crucial for your long-term trading career.

4. Builds Long-Term Growth and Confidence

Confidence doesn’t come from wins it comes from understanding why you win.

A trading journal builds:

- Trust in your strategy

- Trust in your discipline

- Trust in your process

This confidence is what separates long-lasting traders from short-term gamblers.

Positives for Your Personal Life

A trading journal doesn’t just help you become a better trader it can also improve the way you think, react, and make decisions in everyday life. Because trading forces you to manage emotions, stay disciplined, and adapt quickly, journaling those experiences has a surprisingly deep impact on your personal growth.

Below are the expanded personal-life benefits that top traders get from using a trading journal, which directly connect to the psychological improvements that come from documenting trades.

Here’s how journaling helps:

1. Emotional Balance and Stress Control

Trading is emotionally demanding. You deal with uncertainty, unexpected market moves, and the psychological weight of wins and losses. When you journal your trades, you also journal your emotional responses, which helps you:

- Recognize emotional triggers

- Cool down after a loss

- Understand how fear or excitement affects decisions

- Avoid emotional trading (FOMO, revenge trading, hesitation)

- Build self-control that translates to daily life

This emotional self-awareness is one of the biggest benefits of journaling trades, because it reduces stress both on and off the charts.

2. Boosted Confidence and Clear Decision-Making

Confidence doesn’t come from winning trades it comes from understanding why you win and why you lose. A trading journal acts like a personal playbook, helping you build:

- Confidence in your strategy

- Confidence in your risk management

- Confidence in your ability to follow rules

This translates into real life as clearer, faster, and more rational decision-making. You start trusting yourself more, both as a trader and as an individual.

3. Increased Self-Awareness and Personal Growth

When you study your own behavior through a trade journal, you begin noticing:

- Patterns in your discipline

- Habits that hold you back

- Reactions to pressure

- Your strongest and weakest tendencies

This self-awareness leads to powerful personal growth. It helps not only in trading but also in relationships, career decisions, business, and even stress management.

4. Discipline and Routine in Daily Life

Maintaining a trading journal builds lifestyle habits such as:

- Showing up consistently

- Reviewing performance regularly

- Reflecting before reacting

- Respecting routines and rules

These are profitable trader habits, but they are also habits of successful people in general. Journaling helps you develop discipline not just in trading but also in fitness, productivity, and financial management.

5. Resilience and Mental Strength

Every losing trade teaches you something if you document it.

By reviewing your losses in a trading log or trade tracker, you build:

- Patience

- Emotional resilience

- Acceptance of setbacks

- The ability to learn instead of self-criticize

This resilience makes you stronger not only as a trader but in all areas of life where adversity appears.

Risks & Challenges of Maintaining a Trading Journal

Even though a trading journal is one of the most valuable tools for long-term success, traders often face challenges when trying to maintain it. Understanding these obstacles in advance helps you avoid them and use your trade journal effectively.

1. Neglecting the Journal

One of the most common mistakes traders make is starting a journal but failing to maintain it.

Neglect usually happens because:

- Daily entries feel time-consuming

- A trader had a bad day and avoids reviewing it

- They rely too much on memory instead of documented data

- They underestimate how important the trade review process really is

The problem?

A journal only creates value when it’s consistent.

2. Overcomplicating the Journal With Too Many Metrics

Many beginners try to track every possible detail, such as market session, volatility levels, news events, 20+ emotions, and more.

This leads to:

- Burnout

- Inconsistent entries

- Confusion instead of clarity

Your trade journal should evolve over time. Start simple, then add extra trading metrics once you feel comfortable.

3. Recording Trades With Bias

A bias-filled trading log is dangerous because it gives you:

- False success rates

- Inaccurate strategy evaluation

- Misleading trading psychology conclusions

- Poor risk management decisions

Traders commonly skip documenting losing trades. However, losing trades often hold more value than winning ones.

4. Reviewing Without Learning

A major challenge traders face is reviewing trades but not actually improving their trading discipline.

Signs you’re stuck in this loop:

- Repeating the same mistakes

- Reading entries without applying changes

- Using the journal as a diary instead of a tool

- Reviewing only once a month (not enough!)

Learning must be visible in your future trades.

5. Emotional Resistance and Accountability Issues

Documenting your mistakes and emotional lapses is uncomfortable but necessary.

Avoiding accountability is one of the hidden risks of trade journaling:

- Traders fear confronting bad habits

- They avoid logging impulsive trades

- They ignore their worst psychological patterns

But accountability is the key to growth. Journaling forces you to face reality and evolve.

6. Not Reviewing the Journal With Structure

Many traders don’t know how to review their trading journal.

A purposeful review avoids randomness and focuses on:

- Loss reasons

- Setup performance

- Risk management issues

- Emotional triggers

- Strategy refinement

- Behavioral patterns

Without structure, the journal becomes a collection of notes not a growth tool.

Actionable Steps to Start Using a Trading Journal Today

Beginners often feel confused about how to properly start a trade journal.

Below is a practical, step-by-step guide aligned with search intent such as “how to start a trading journal,” “how to journal your trades,” and “best way to track trading performance.”

1. Start With the Essentials (Don’t Overthink It)

Your first trading journal entries should focus on just a handful of key details:

- Trade direction (Buy/Sell)

- Entry price

- Exit price

- Stop-loss and take-profit

- Lot size / contract size

- Reason for entering

- Screenshot of the setup

- Emotion before, during, and after the trade

This helps you build a simple and repeatable trade tracker system.

2. Add More Context as You Build Consistency

After documenting 7–10 trades, you’ll start seeing patterns. This is the perfect time to add more variables such as:

- Market conditions (trend, range, news, volatility)

- Session (London, New York, Asia)

- Technical reasons (breakout, retracement, continuation)

- Mistakes and rule violations

- Risk-to-reward ratio

- Strategy category (e.g., breakout strategy, supply and demand, scalping setup)

These details give you clearer insights into your trading discipline and performance.

3. Use Weekly and Monthly Review Templates

Your trading journal is only powerful when you review it properly.

Weekly Review Checklist

- Which setups performed best?

- Which trades were emotional?

- Did I follow my risk management rules?

- Which mistakes repeated?

- What should I avoid next week?

Monthly Review Checklist

- Updated win rate

- Average R:R

- Best/worst trading days

- Strategy performance breakdown

- Drawdown patterns

- Psychological weaknesses

This structured trade review process is the foundation of long-term improvement.

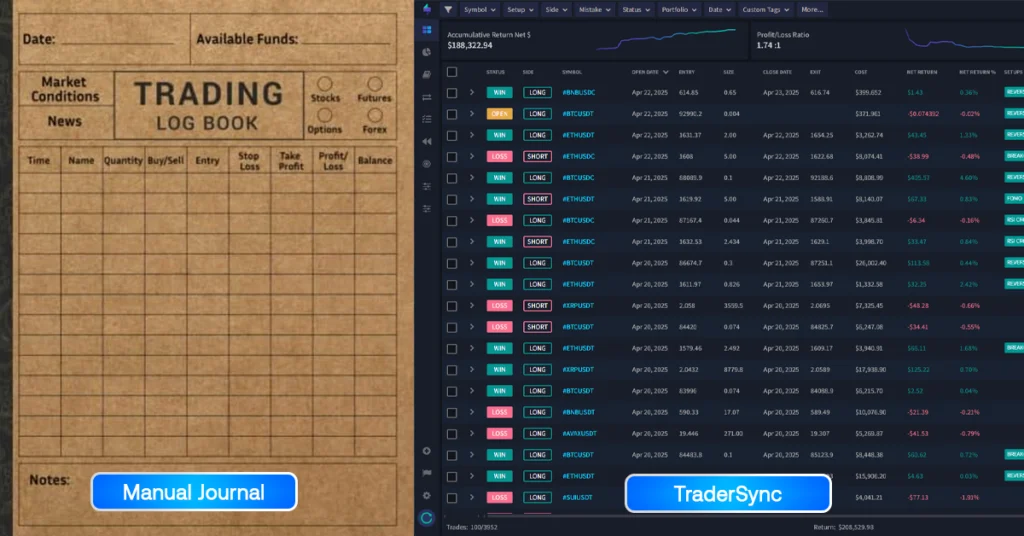

4. Use a Digital Trading Journal for Automation and Accuracy

If you’ve ever tried keeping a trading journal using pen and paper, you already know the struggle: pages get messy, screenshots sit in random folders, numbers don’t match, and after a few weeks… the journal quietly dies.

Not because you’re lazy but because manual journaling simply doesn’t match the speed of modern trading.

That’s exactly why more traders today shift from handwritten logs to digital trading journals. They’re built to handle what real traders face every day: rapid entries, fast-changing charts, emotional swings, and the need for instant, honest data.

To understand the difference, imagine two traders:

| The Manual Journaler | The Digital Journaler |

|---|---|

| He finishes a USD/JPY trade. | Finishes the same USD/JPY trade |

| He opens his notebook. | Opens digital trading journal, something beginner-friendly like TraderSync |

| He flips through three sections to find the right page. | |

| He writes entry and exit prices. | |

| He tries to calculate R:R in his head. | |

| He goes to “Downloads” to hunt for the screenshot. | |

| He forgets what emotion he felt when entering the trade. | |

| He promises to review it later… but never does. |

Within weeks, The Manual Journaler, has:

- scattered screenshots,

- incomplete notes,

- missing data,

- and zero motivation to continue.

His journal becomes history, not a tool for improvement.

While for the The Digital Journaler, the trade is auto-imported from the broker.

- A screenshot is attached with one click

- The system calculates R:R and performance metrics

- She tags the setup (“breakout”, “NY session”, “rule violation”)

- Her emotional state is added through simple mood logs

- Her dashboard updates automatically

This entire process takes less than 30 seconds.

5. Build the Habit With Small Daily Actions

Consistency comes from simplicity.

Here’s a routine beginners can follow:

After each trade:

→ Add details + screenshot (30–60 seconds)

End of each day:

→ Write 1–2 sentences about psychological patterns

End of each week:

→ Weekly review (5–10 minutes)

End of each month:

→ Deep analysis (20–30 minutes)

This creates automated profitable trader habits and keeps your trade journal meaningful.

6. Set Growth Goals Based on Your Journal

Use your trading log to set measurable improvement goals:

- Reduce impulsive trades by 30%

- Improve average R:R from 1.2 to 1.5

- Follow risk management rules 95% of the time

- Trade only top 3 setups

- Avoid trading during emotional stress

These goals align your journal with real performance improvement.

The Concluding Remarks

A trading journal isn’t just a logbook, it’s your roadmap to becoming a disciplined, confident, and consistently profitable trader.

It improves your trading psychology, strengthens your strategy, and builds long-term success. Whether you’re new or experienced, journaling your trades can unlock performance improvements you didn’t know were possible.

If you’re ready to take your trading seriously, start today with a beginner-friendly tool like TraderSync your future self will thank you.

Yes, journaling helps you identify mistakes, refine strategies, and develop profitable trader habits. While it doesn’t guarantee profits, it dramatically increases consistency.

Paper works, but digital journals like TraderSync offer automation, performance tracking, and analytics. They save time and provide deeper insights.

Once a week is ideal. A weekly review helps you see patterns and make adjustments without feeling overwhelmed.

Paper is a good way to start and to build the habit. However, a digital trading journal like TraderSync becomes invaluable as your trade count grows. It automates calculations, enables powerful searching for patterns, and visualizes your data in ways a notebook simply can’t, making your review process far more efficient and insightful.