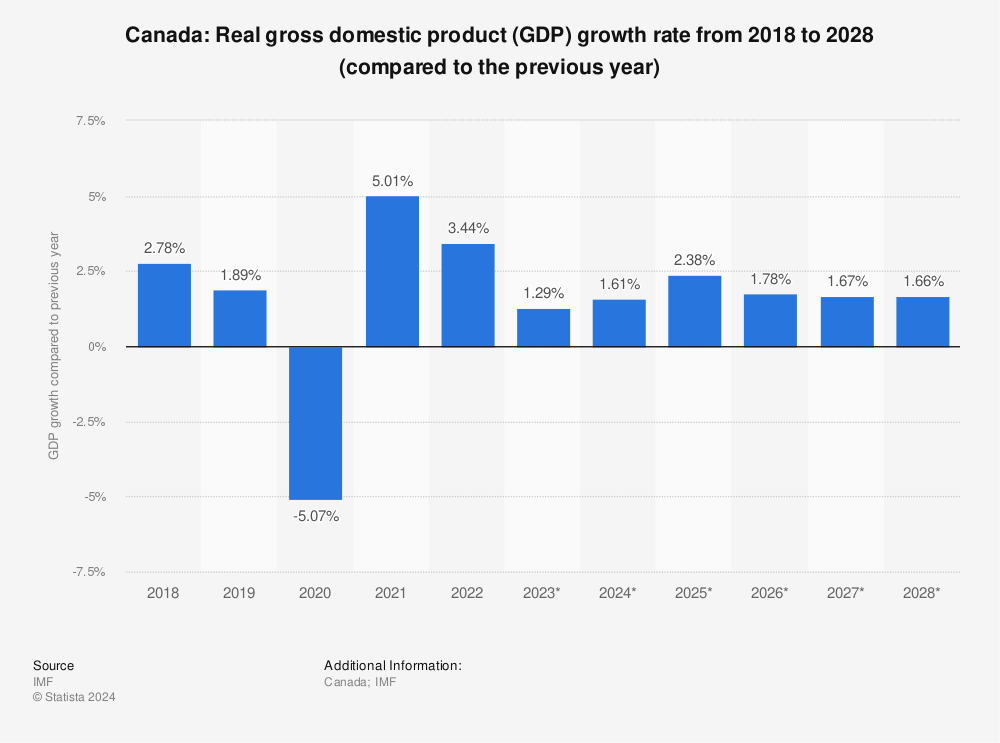

Recent data reveals that the Canadian economy is slowing down. Growth reached 0.5% in the second quarter of 2024, slightly up from 0.4% in the first quarter. However, challenges are emerging, with the economy shrinking per capita for the fifth consecutive quarter and household spending weakening.

Growth Slows as Key Sectors Falter

Although the economy grew, government spending and business investments drove this increase. In contrast, exports, housing construction, and spending on goods dropped. Export performance declined by 0.4%, particularly due to lower demand for metals, cars, and energy products.

Residential construction faces significant hurdles, with eight out of the last nine quarters showing reduced investment. Housing investment decreased by 1.9%, with Ontario leading the cooling market.

“The government and businesses are supporting the Canadian economy, but weak exports and residential construction are signs of deeper issues,” said an analyst from RBC Economics. “Stabilizing these sectors will be crucial for sustainable growth.”

Household Spending and Savings Under Pressure

Household spending grew by only 0.2% in the second quarter, down from 0.9% in the first. Rising costs for housing, food, and electricity squeezed consumers, while vehicle purchases and overseas travel dropped. Per capita spending fell by 0.4%, highlighting that population growth is outpacing economic expansion.

Savings increased to 7.2% as Canadians responded to higher wages. However, rising mortgage and loan payments offset these gains. Many households still feel the effects of 2022’s interest rate hikes.

“The cost of living is forcing Canadians to save more, but interest payments are reducing disposable income,” a CIBC expert commented.

What’s Next for the Canadian Economy?

As 2024 progresses, experts remain divided on the Canadian economy’s future. The Bank of Canada cut interest rates twice this year, providing some relief. Yet, inflation remains a concern, especially in the services sector. Prices for household services continue to rise, placing further pressure on families.

Energy remains a crucial sector. Business investment in non-residential structures grew by 0.5%, with a focus on energy projects. This sector shows resilience but depends on global demand for oil and gas, as well as the transition to green energy.

Corporate profits rebounded in the second quarter, rising 3.1%. The oil and gas sector led the recovery, but uncertainty persists for the broader corporate landscape. Financial corporations posted modest gains.

Challenges and Opportunities

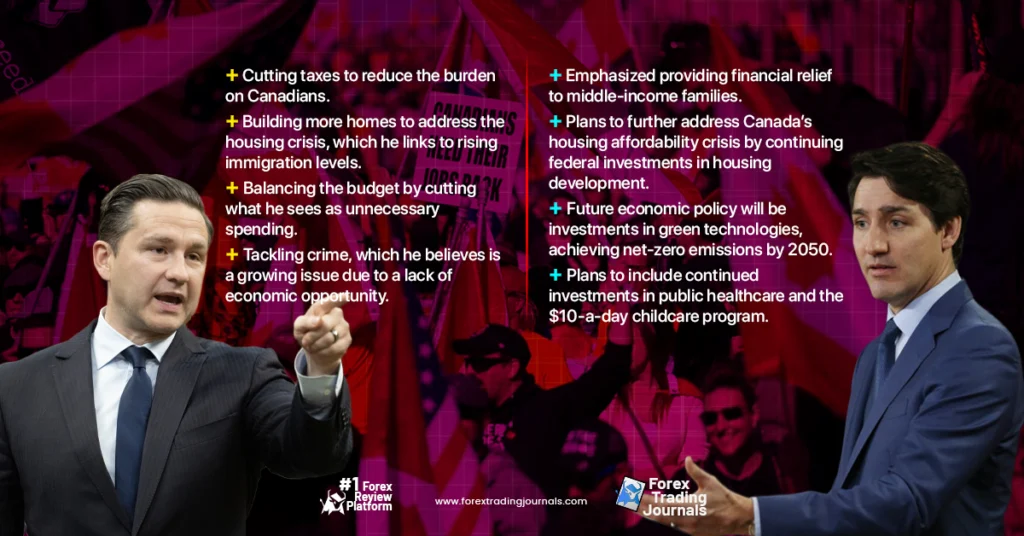

The Canadian economy must navigate a challenging environment in the coming quarters. The government may need to introduce new stimulus measures. Businesses will need to adapt to changing global trade conditions and domestic issues, including high debt levels and housing affordability concerns.

“Canada’s economy has shown resilience, but further growth will require policies that target sectors like technology, energy, and housing,” said a Scotiabank economist. “Without action, the country could face prolonged slow growth.”

For now, the Canadian economy continues to expand. However, much depends on how quickly exports recover, housing stabilizes, and inflation is controlled.