The Consumer Price Index (CPI) is an important economic indicator that tracks the cost of goods and services, helping to determine inflation trends. Known as “headline inflation,” the CPI plays a significant role in influencing central bank decisions on interest rates to meet inflation targets. For forex traders, understanding how CPI data affects currency values is essential to navigating the market effectively.

Why Is the Consumer Price Index (CPI) Important for Forex Traders?

The CPI is crucial for central banks as it helps them maintain price stability and control inflation over time. By tracking the average prices of a basket of goods and services—such as food, transportation, and healthcare—the CPI measures the overall inflation in an economy. If inflation rises, the cost of buying these goods and services increases, and when inflation drops, these costs decrease.

For forex traders, the Consumer Price Index in Forex trading acts as a signal for potential changes in interest rates, which directly influence currency values. A rise in CPI can influence central banks to raise interest rates, leading to stronger currencies, while lower inflation may result in lower interest rates, weakening the currency.

When Is the CPI Released?

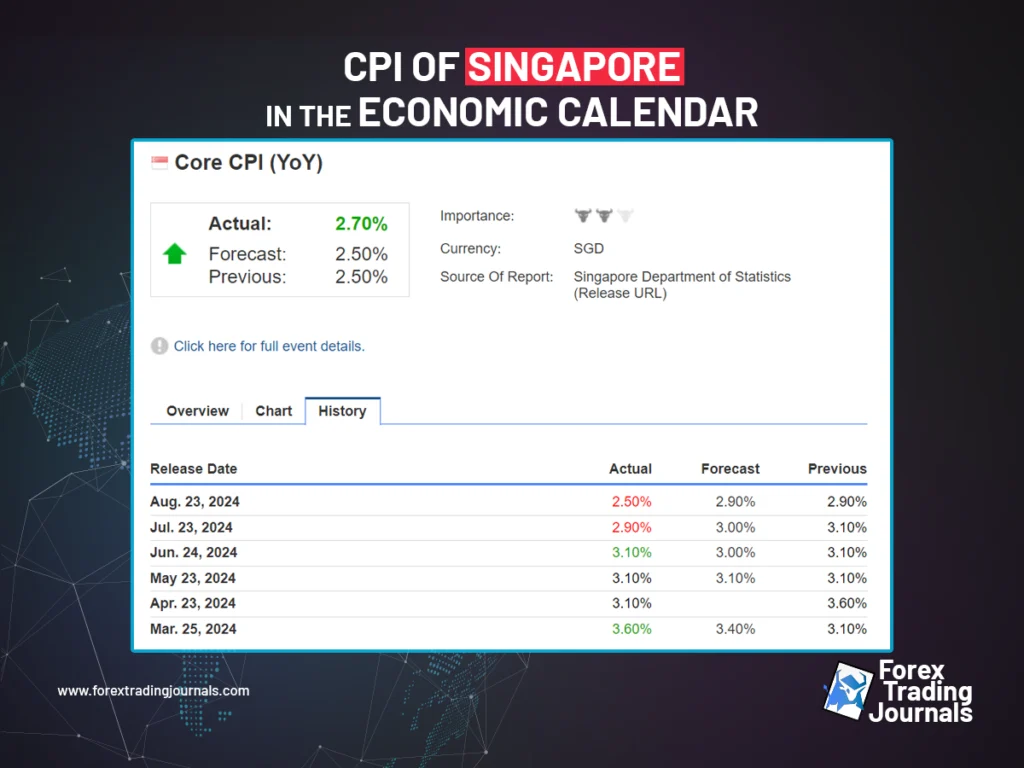

The U.S. Bureau of Labor Statistics has published the Consumer Price Index (CPI) on a monthly basis since 1913. Other countries release their CPI data at different intervals; for instance, Australia releases quarterly reports, while Germany issues an annual report. Keeping track of when CPI reports are released is essential for traders to prepare for potential market movements. This can be easily found in the forex economic calendar.

Forex Trading Strategy Using Consumer Price Index (CPI) Data

For forex traders, a trading strategy based on the Consumer Price Index in Forex involves closely monitoring the market’s inflation expectations and analyzing the implications for the currency. Traders can add technical analysis to their strategy, assessing how price reacts to key support and resistance levels after the CPI release. Indicators such as Fibonacci retracements or moving averages can provide insight into the strength of the market move following the data release.

It’s also important to consider the timing of your trades around CPI releases. CPI in Forex trading often leads to increased volatility, and spreads can widen before and after the announcement. As such, entering a position right before the release may expose traders to unnecessary risk.

Conclusion

The Consumer Price Index in Forex trading is an essential indicator for understanding inflation trends and their impact on central bank decisions. For forex traders, CPI releases can provide valuable insights into potential currency movements, making it an important part of any trading strategy. However, like any other economic indicator, using CPI effectively requires a combination of fundamental analysis, technical tools, and careful timing. With the right approach, traders can tackle the power of CPI data to make more informed and profitable trades.