In the world of forex trading, understanding pips (percentage in points) is very important. Pips represent the smallest unit of price movement in currency pairs, and accurately calculating them is essential for risk management, position sizing, and profit projections.

The Importance of the Pip Calculator

Accurate Position Sizing: A pip calculator allows traders to determine the appropriate position size for each trade, taking into account their risk tolerance and desired risk-reward ratio. By accurately sizing positions, traders can manage their capital effectively and control potential losses.

Risk Management: Calculating pips helps traders determine the stop-loss and take-profit levels for their trades. By setting these levels based on pip values, traders can establish a predetermined risk-reward ratio and protect their capital from excessive losses.

Profit Projection: A pip calculator assists traders in estimating potential profits for a given trade. By knowing the pip value and the number of pips the price is expected to move, traders can forecast the potential gains and make informed trading decisions.

Efficient Use of the Pip Calculator

Selecting the Right Calculator: Various pip calculators are available online, offering different features and functionalities. A calculator that fits well with your type of trading is significant. Look for calculators that allow customization of currency pairs, lot sizes, and account currencies.

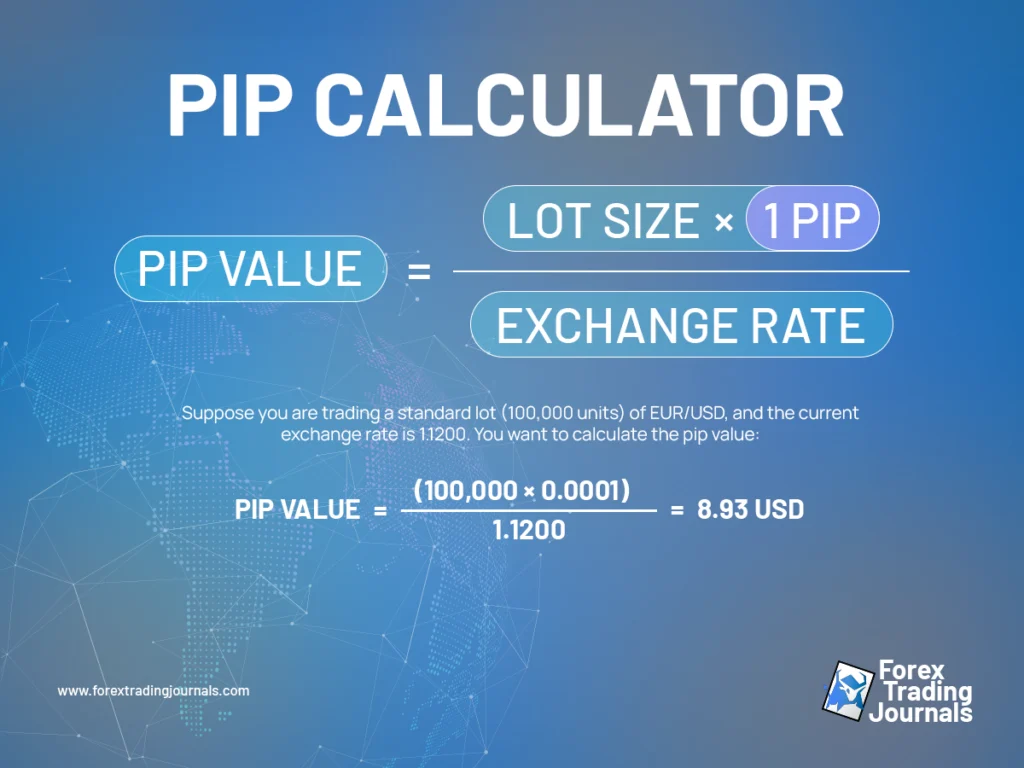

Inputting Relevant Information: To use the pip calculator efficiently, you need to input accurate information. This includes the currency pair you are trading, your account currency, and the trade size (lot size or position size). Additionally, consider including the current exchange rate, especially when trading cross-currency pairs.

Calculating Pip Value: Once you have input the necessary information, click on the calculate button to obtain the pip value. The calculator will provide the pip value in the account currency, which can then be used for position sizing, stop-loss and take-profit placement, and profit projections.

Considering Pipettes: Some currency pairs quote prices with an additional decimal place, known as a pipette. Pipettes are fractions of a pip and are relevant when trading pairs with tighter spreads. Ensure your pip calculator accounts for pipettes if trading such pairs.

Understanding Different Lot Sizes: Most pip calculators allow you to choose between standard lots, mini lots, and micro lots. Familiarize yourself with the different lot sizes and their respective pip values to accurately calculate position sizes based on your risk management strategy.

Practical Examples and Tips

Practical Examples and Tips

- Input your account currency, the currency pair being traded, and the desired risk percentage.

- Determine the stop-loss level in pips.

- The pip calculator will then calculate the appropriate position size based on the given information.

Estimating Profit Potential

- Input your account currency, the currency pair being traded, and the number of pips you expect the price to move.

- The pip calculator will provide an estimation of the potential profit based on the pip value and the number of pips.

Additional Tips

- Familiarize yourself with the pip values of different currency pairs to gauge their volatility and potential profit potential.

- Regularly review and update your pip calculator settings to reflect changes in your trading account or currency pairs you trade.

- Understand the limitations of pip calculators and use them as a tool for guidance, not as the sole determinant of your trading decisions.

Conclusion

Mastering the pip calculator is essential for efficient risk management, position sizing, and profit estimation in forex trading. By accurately calculating pip values and utilizing the calculator effectively, traders can make informed decisions and maintain control over their trading outcomes. Embrace the pip calculator as a valuable resource in your trading toolkit, and enhance your trading efficiency and profitability.

Frequently Asked Questions (FAQ)

How can I use the economic calendar to improve my trading strategies?

By regularly checking the economic calendar, you can stay informed about upcoming economic events, indicators, and news releases. This knowledge allows you to anticipate market movements, identify potential trading opportunities, and adjust your strategies accordingly.

What are the benefits of filtering and customizing the economic calendar?

Filtering and customizing the economic calendar allow you to focus on specific regions, countries, event types, and timeframes that are most relevant to your trading interests. This helps you streamline your research and analysis, saving time and improving your decision-making process.

Why is it important to consider the impact of each economic event?

The impact of economic events can vary, with some having a higher potential to influence the markets. By assessing the importance level assigned to each event and analyzing the previous and forecasted values, you can gauge the potential market reaction and make more informed trading decisions.

How can I identify trading opportunities using the economic calendar?

High-impact events and significant discrepancies between forecasted and previous values can indicate potential trading opportunities. By focusing on events that align with your trading strategy and show potential for volatility, you can identify favorable entry and exit points for your trades.

What role does a trading plan play in utilizing the economic calendar?

Developing a trading plan based on the events listed on the economic calendar helps you establish a systematic approach to your trades. It includes considerations such as entry and exit points, risk management strategies, and position sizing, providing a structured framework for executing your trades with discipline.

How does a pip calculator contribute to successful trading?

A pip calculator is essential for accurate position sizing, risk management, and profit projection in forex trading. It allows you to determine the appropriate position size based on your risk tolerance and desired risk-reward ratio. Additionally, it helps you set stop-loss and take-profit levels based on pip values, and estimate potential profits for a given trade.

Why is precision important when using a pip calculator?

Precision is crucial when using a pip calculator to ensure accurate position sizing and profit estimation. By inputting the correct currency pair, account currency, and trade size, you can obtain precise pip values that align with your trading goals and risk management strategy.

How can I use a pip calculator effectively?

To use a pip calculator effectively, input the relevant information accurately, including the currency pair, account currency, trade size, and potentially the current exchange rate. Consider any additional decimal places or pipettes when applicable. Regularly review and update your pip calculator settings to reflect changes in your trading preferences or account details.

Can a pip calculator determine my trading success?

While a pip calculator is a valuable tool for risk management and position sizing, it is important to remember that trading success depends on a combination of factors. Utilize the pip calculator as part of your overall trading strategy, incorporating other analysis techniques, market research, and sound decision-making processes for optimal results.