As the 2024 U.S. presidential election heats up, one of the most critical topics is the future of U.S. debt. With federal debt levels expected to break post-World War II records by 2027, both Vice President Kamala Harris and former President Donald Trump have laid out economic policies that will greatly impact the national deficit. Their contrasting approaches could significantly shape the nation’s fiscal health and affect everyday Americans.

Trump’s Approach: Tax Cuts and Tariffs

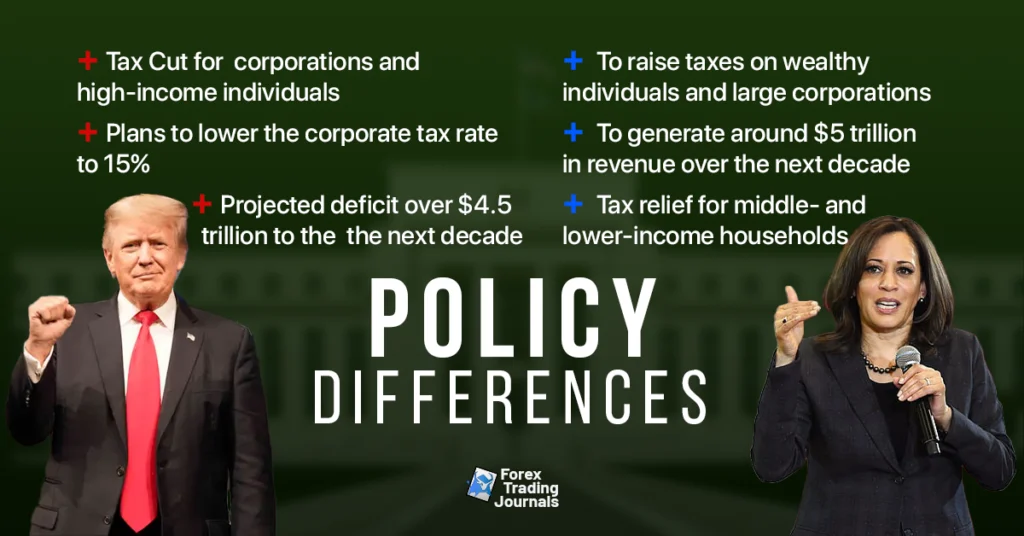

Donald Trump’s economic vision includes major tax cuts, particularly for corporations and high-income individuals. His plan to lower the corporate tax rate to 15% for “American producers” aims to stimulate business investment, but it poses a significant risk of deepening the deficit. Historical data from Trump’s 2017 Tax Cuts and Jobs Act showed a 41% reduction in corporate tax collections. While it did spur some economic growth, the policy ultimately contributed to the swelling of U.S. debt. If similar policies are enacted again, it is projected that they will add $4.5 trillion to the deficit over the next decade.

Trump’s plan also includes generating revenue through global tariffs. While this could bring in approximately $2 trillion over ten years, these tariffs would increase the cost of imported goods, placing a heavier burden on American consumers. This approach could help reduce U.S. debt on paper, but it would come at a cost to families across the country, who would feel the pinch of higher prices.

Harris’s Approach: Tax Hikes for the Wealthy and Targeted Relief

Kamala Harris takes a fundamentally different approach to managing U.S. debt. Her plan focuses on raising taxes on wealthy individuals and large corporations, which could generate around $5 trillion in revenue over the next decade. Harris’s strategy seeks to address the deficit responsibly while making critical investments in infrastructure, education, and healthcare.

A key aspect of Harris’s fiscal approach is providing tax relief for middle- and lower-income households. Her plan includes expanded tax credits for families, small businesses, and first-time homeowners, ensuring that those who are most vulnerable receive support. While her policies may modestly increase the deficit, they are far less likely to inflate U.S. debt compared to Trump’s tax cuts, offering a more balanced fiscal outlook.

The Clear Fiscal Choice

When it comes to managing U.S. debt, the contrast between Trump and Harris is stark. Trump’s reliance on tax cuts for the wealthy and tariffs would likely lead to a significant increase in the deficit, adding trillions to U.S. debt over the next decade. On the other hand, Harris’s approach focuses on generating revenue from the wealthy and providing relief to working families, making her the more fiscally responsible candidate.

Ultimately, how these different approaches will impact the economy, the deficit, and everyday Americans remains to be seen. As voters, we face the decision of which vision for the future of U.S. debt aligns most with our priorities and concerns.