Forex trading, also referred to as currency trading or foreign exchange trading, encompasses the purchase and sale of currencies within the global foreign exchange market. This decentralized market operates continuously, 24 hours a day and five days a week, facilitating the trading of various currencies. Forex trading involves speculating on the price fluctuations of currency pairs in order to make a profit.

Forex trading has become increasingly popular in recent years, as it offers individuals the opportunity to participate in the global currency market and potentially generate profits. This article aims to provide a comprehensive overview of forex trading, covering its fundamental concepts, trading strategies, risk management techniques, and more.

Understanding the Forex Market

The foreign exchange market, commonly known as the forex market, stands as the largest and most liquid financial market globally, facilitating the trading of currencies on a massive scale. It operates on a global scale, with participants including banks, financial institutions, corporations, governments, and individual traders. Unlike traditional stock markets, the forex market does not have a centralised exchange. Instead, it functions through an electronic network of banks, brokers, and other financial institutions.

Basics of Forex Trading

Forex trading is the act of buying one currency and selling another, just like buying and selling stocks. Currency pairs are traded on the forex market, with the value of one currency relative to the other constantly changing. Traders aim to profit from these fluctuations by speculating on whether a currency will appreciate or depreciate in value.

To participate in trading forex, traders need a forex broker who provides access to the market. They can execute trades using trading platforms that offer real-time price quotes, charts, technical indicators, and other tools to assist in decision-making.

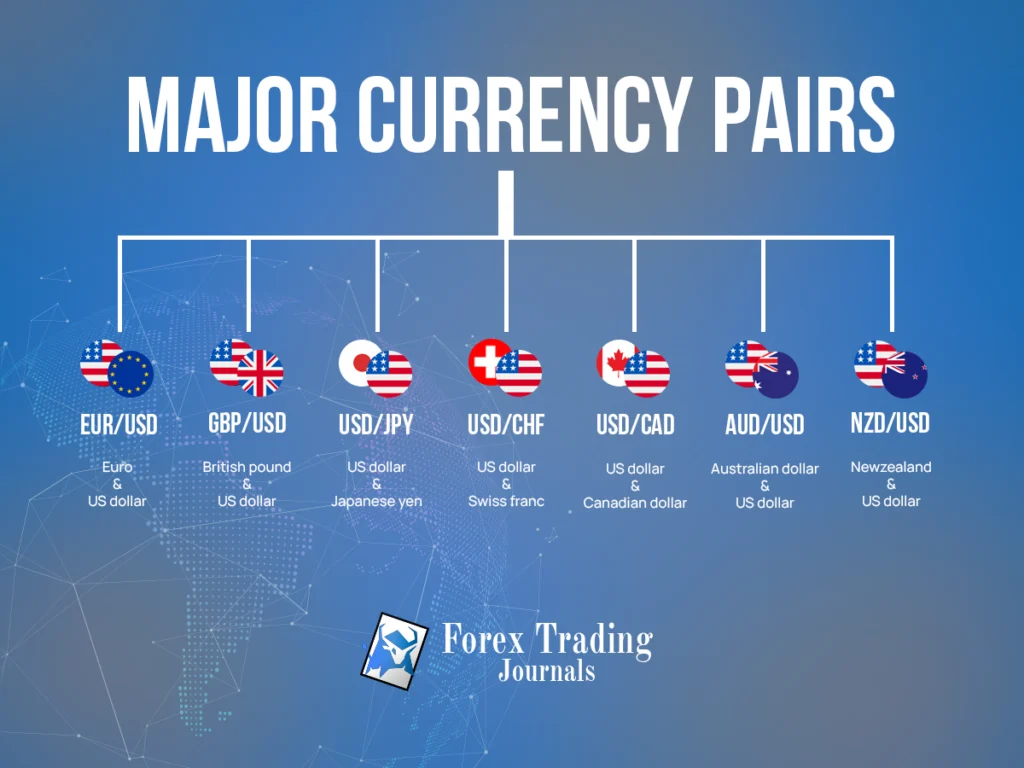

Major Currency Pairs

The forex market consists of numerous currency pairs, but some pairs are more actively traded than others. These are known as major currency pairs and include pairs such as EUR/USD, GBP/USD, USD/JPY, and USD/CHF. Major currency pairs offer higher liquidity, tighter spreads, and more predictable price movements, making them popular among traders.

Trading Platforms and Tools

Trading platforms play a crucial role in forex trading, as they provide the necessary tools and features for executing trades. These platforms offer a user-friendly interface, real-time market data, charting capabilities, order types, and risk management tools. Popular trading platforms such as MetaTrader, cTrader, and TradingView are widely used in trading.

Fundamental Analysis in Forex Trading

Fundamental analysis involves assessing economic, political, and social factors that influence currency values. Traders analyze indicators such as interest rates, inflation rates, GDP growth, employment data, and geopolitical events to make informed trading decisions. Fundamental analysis helps traders understand the broader market trends and long-term outlook for a currency pair.

Technical Analysis in Forex Trading

Technical analysis focuses on analyzing historical price data and identifying patterns or trends that can help predict future price movements. Traders use various technical indicators, chart patterns, and candlestick formations to identify entry and exit points. Technical analysis is based on the belief that historical price behavior tends to repeat itself, allowing traders to anticipate potential price movements.

Risk Management and Leverage

Risk management is crucial in forex trading to protect capital and minimize losses. Traders use techniques such as setting stop-loss orders, implementing proper position sizing, and diversifying their portfolio.

In forex trading, leverage plays a significant role as it enables traders to command larger positions in the market using a smaller amount of capital. This leverage feature is widely employed by traders to enhance their trading potential and maximize opportunities. While leverage can amplify profits, it also increases the risk of significant losses.

Choosing a Forex Broker

Choosing a trustworthy and reputable forex broker is extremely important for achieving success in trading. The selection of a reliable broker plays a decisive role in providing a secure and conducive trading environment. Traders should consider factors such as regulation, trading platforms, customer support, trading costs, available currency pairs, and educational resources. It is important to choose a broker that aligns with individual trading goals and preferences.

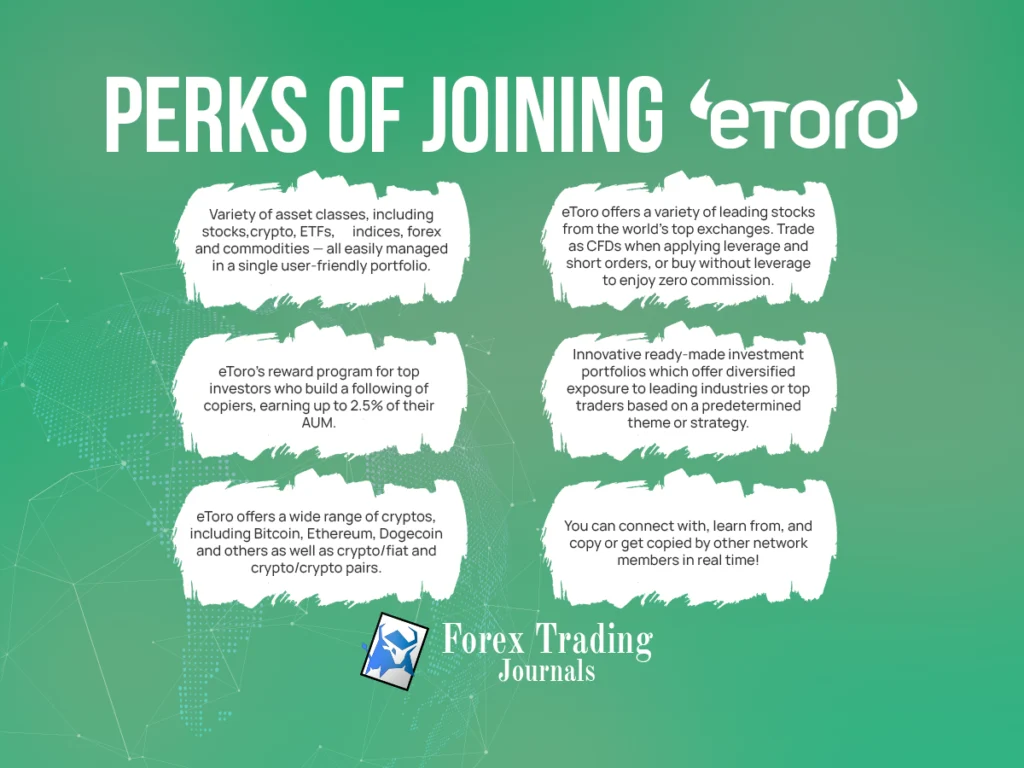

Let me introduce you to a broker that offers a multitude of perks to enhance your currency trading experience, Look no further than eToro. With eToro, you’ll enjoy the advantages of low trading fees, including a mere 1% commission on currency trades, which is significantly lower than the industry average. Their copy trading feature allows you to effortlessly replicate the trades of successful traders, making it an ideal learning tool for beginners.

Furthermore, eToro’s social trading platform enables you to connect with fellow traders, exchange ideas, and gain valuable insights. With a wide range of tradable assets, including forex, stocks, commodities, and cryptocurrencies, eToro provides the flexibility to invest in markets that interest you.

Their user-friendly platform, accessible on mobile devices, ensures a seamless trading experience. eToro also offers additional perks such as their premium membership program (eToro Club), Popular Investor program, and eToro Money account, making them a top choice for traders seeking a broker with a comprehensive set of benefits. Before you choose etoro as your broker, you should read their thorough trader review of them.

Developing a Trading Strategy

A trading strategy serves as a comprehensive framework of rules and criteria that direct a trader’s decision-making process, providing guidance and structure to their trading activities. It includes parameters for entering and exiting trades, risk management rules, and criteria for selecting currency pairs. A well-defined trading strategy helps traders maintain discipline and consistency in their trading approach.

Emotional Discipline in Forex Trading

The influence of emotions on trading decisions should not be underestimated, as they have the potential to drive irrational behavior and significantly impact the outcome of trades. Maintaining emotional discipline is paramount for making rational and objective trading choices. Successful forex traders maintain emotional discipline by controlling fear, greed, and impulsive reactions. They follow their trading plan and avoid making impulsive decisions based on short-term market fluctuations.

Popular Currency Trading Strategies

There are various trading strategies employed by currency traders, each with its own approach and risk profile. Some popular strategies include trend following, breakout trading, range trading, and scalping. Traders may choose a strategy based on their trading style, time availability, and risk tolerance.

Trading Time Zones

The trading market operates 24 hours a day, five days a week, due to the overlapping trading sessions of major financial centers around the world. The primary trading sessions in the fx market comprise the Sydney session, Tokyo session, London session, and New York session. These distinct sessions mark different time zones and play a vital role in determining market activity and liquidity levels. Understanding the different time zones and their corresponding market activity can help traders identify optimal trading opportunities.

Economic Events

Economic events, such as central bank announcements, economic data releases, and geopolitical developments, can have a significant impact on currency prices. Traders closely monitor these events and their potential impact on the market. Economic calendars and news sources provide information on upcoming events that may influence currency markets.

Conclusion

Forex trading presents a wide-ranging opportunity for individuals, as it enables them to actively participate in the global currency market and generate profits. It requires a solid understanding of market dynamics, risk management techniques, and trading strategies. By employing solid strategies and staying informed about market trends, traders can strive for success in the forex market.

FAQs

The minimum amount required varies by broker and account type. Some brokers allow accounts with as little as $100, but higher capital offers better risk management and trading flexibility. It’s important to assess your financial situation and risk tolerance before investing.

Yes, forex trading can be profitable, but it carries inherent risks. Success depends on informed decisions, effective strategies, and proper risk management. Traders should invest time in learning and skill development to improve their chances of profitability.

Time commitment depends on your trading style and preferences. The forex market operates 24/7, allowing for flexible schedules. Whether full-time or part-time, traders should allocate time for market analysis, staying updated on economic events, and skill improvement.

A pip (“percentage in point”) is the smallest price movement in a currency pair. For most pairs, it’s the fourth decimal place; for pairs involving the Japanese Yen, it’s the second. Pip value varies by currency pair and trade size, and it’s crucial for calculating profits or losses.

Yes, it can be. Beginners should first understand forex concepts, market behavior, risk management, and strategies. Resources like demo accounts and educational tools are helpful. Starting with small trades and focusing on learning is recommended.