Forex trading can be fast and unpredictable, especially when the market becomes volatile. One of the most effective tools to protect your trading capital is stop-loss trading. A well-placed stop loss can help you limit losses and secure profits. However, in a volatile market, setting your stop loss levels requires extra care and strategy. In this guide, we’ll show you how to set stop losses that will help you thrive during unpredictable market conditions.

The Importance of Stop Loss Trading in Forex Markets

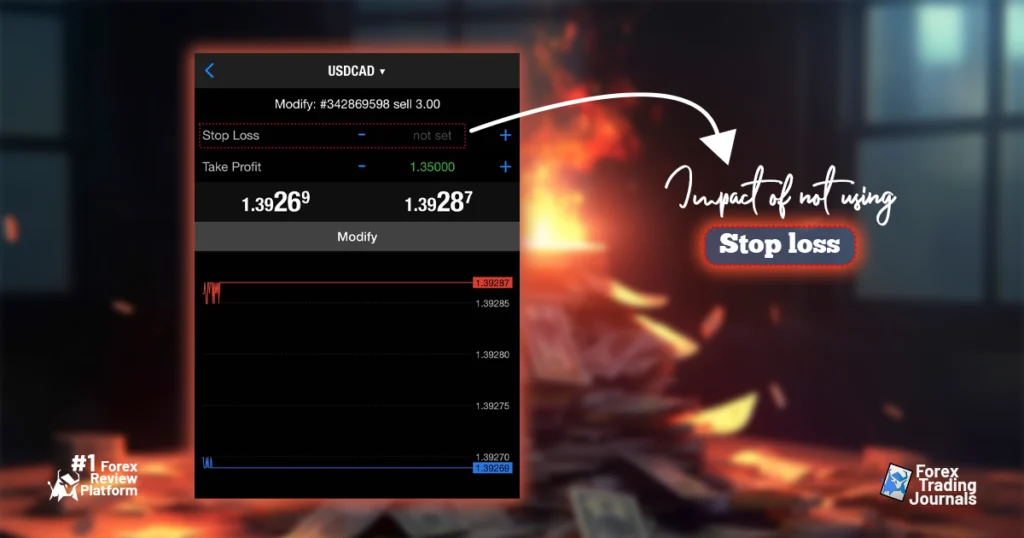

Stop-loss trading is a significant part of any successful forex strategy. Without a solid stop-loss strategy in place, even the most skilled traders can experience devastating losses. In this section, we’ll break down why stop-loss trading is essential, especially in the fast-moving world of forex trading, and how it can protect your capital while maximizing your long-term profitability.

1. Protect Your Capital with Stop Loss Trading

The primary goal of stop loss is to protect your trading capital. Forex markets are highly volatile, and prices can move sharply in either direction. Without a stop loss in place, a trade that moves against you can wipe out a significant portion of your account.

1.1. Limiting Losses in Unpredictable Markets

In volatile or unpredictable markets, stop loss orders serve as a safety net. When prices move against your position, a well-placed stop loss will automatically close your trade before the losses become unmanageable. This allows you to limit your risk on each trade and protect your capital from unexpected market movements.

1.2. Avoid Emotional Decision Making

Emotions often cloud judgment during live trades. Traders without a stop loss tend to hold on to losing positions, hoping for a turnaround. Unfortunately, this often leads to even greater losses. Stop loss takes the emotion out of the equation, enforcing a pre-planned exit point that helps prevent irrational decisions driven by fear or greed.

2. Consistency and Discipline in Stop Loss Trading

A key benefit of stop loss is that it enforces consistency and discipline, which are critical traits of a successful trader. By adhering to a strict stop loss strategy, you can maintain a level-headed approach to the market and reduce the impact of impulsive decisions.

2.1. Risk Management

A good stop loss trading strategy allows you to manage your risk effectively. With stop losses in place, you can calculate your maximum potential loss before entering a trade, ensuring that no single trade can destroy your account. This is especially important for traders who trade with leverage, where losses can be magnified.

2.2. Long-Term Profitability

While stop loss trading may result in some losses in the short term, it helps you stay in the game for the long term. Small, manageable losses are part of trading, but stop loss trading ensures that these losses don’t spiral out of control. This allows you to focus on the bigger picture and aim for consistent profits over time.

3. Enhanced Focus on Trade Setup and Execution

By having a stop loss in place, traders can focus more on executing their trading strategy rather than worrying about how much they could potentially lose. Stop loss trading simplifies decision-making and lets you concentrate on finding quality trade setups.

3.1. Improved Trade Planning

When you use stop loss trading, you are forced to think carefully about each trade before placing it. This includes setting clear entry and exit points and considering your risk-reward ratio. By planning your trades thoroughly, you can improve your overall trading performance.

3.2. Better Control Over Risk-Reward Ratios

A proper stop loss trading strategy lets you maintain a healthy risk-reward ratio. For example, if you risk 50 pips with a stop loss, you can aim for a profit target of 100 pips, maintaining a 1:2 risk-reward ratio. This helps ensure that your profitable trades outweigh your losses, keeping you consistently in the green.

4. Stop Loss Prevents Overtrading

Overtrading, or taking too many positions, is a common problem among traders, especially in volatile markets. Stop loss trading can help you avoid this by encouraging disciplined, well-planned trades.

4.1. Quality Over Quantity

By using stop losses, you will be more selective with your trades. You’ll be less tempted to chase the market or jump into random trades without a solid plan. This focus on quality rather than quantity can significantly improve your win rate and reduce unnecessary trading.

4.2. Reduces Trading Fatigue

Overtrading can lead to exhaustion and poor decision-making. Stop loss helps you stick to your trading plan, avoid excessive trading, and maintain your focus. This, in turn, leads to more consistent results and less mental fatigue from constant market monitoring.

5. Stop Loss Trading Offers Flexibility in Volatile Markets

Markets can be highly volatile, particularly around major economic events or news releases. Stop loss offers flexibility by allowing you to adapt your strategy to changing market conditions.

5.1. Adjusting Stop Losses for Volatility

In periods of high volatility, you may need to set wider stop losses to avoid getting stopped out by normal market fluctuations. By adjusting your stop loss distance based on the current volatility, you give your trades room to breathe while still protecting your capital.

5.2. Trailing Stop Losses to Lock in Profits

Using trailing stops in volatile markets can help you lock in profits as the market moves in your favor. A trailing stop automatically adjusts as the price moves, allowing you to capture gains while still limiting your downside risk if the market reverses unexpectedly.

How to Set Stop Loss Effectively

1. Understand Market Volatility

Volatility refers to how much and how quickly market prices move. Significant events such as economic data releases, political developments, or global crises frequently instigate high volatility. When volatility spikes, prices can swing sharply, making it crucial to have an effective stop loss plan in place. Traders without a well-thought-out strategy risk losing large sums of money. To stay protected, you must adjust your stop loss levels based on current market volatility.

2. How to Use the ATR Indicator for Stop Loss Trading

The Average True Range (ATR) is a popular tool for measuring volatility. It tells you how much a currency pair typically moves over a certain period. In volatile markets, the ATR increases, signaling that prices are moving more aggressively. In such situations, you should set wider stop losses. Conversely, when the ATR is low, you can use tighter stops.

Example:

If the ATR of a currency pair is 50 pips, you might set your stop loss at 1.5 times the ATR, which would be 75 pips. This prevents your trade from being prematurely stopped out by regular price fluctuations.

This stop loss trading strategy helps you adapt to different levels of volatility and avoid unnecessary losses.

3. Avoid Setting Stop Losses Too Close

One of the most common mistakes in stop loss trading during volatile markets is setting the stop loss too close to the market price. When the market swings wildly, your stop loss could be hit by temporary spikes, even if your overall trade direction is correct. To avoid this, place your stop losses further away from the current price, allowing the trade room to move naturally.

Example:

If you’re trading a volatile currency like GBP/JPY, which can move 100 pips in a few minutes, setting your stop loss 20 pips away might be too tight. A more strategic approach would be to place the stop near key support or resistance levels.

4. Adjust Your Position Size Based on Stop Loss Distance

When you set wider stop losses in volatile markets, it’s essential to adjust your position size accordingly. This keeps your overall risk in check while allowing for greater flexibility. Stop loss trading isn’t just about where you place the stop, but also about managing your exposure.

Example:

If you normally risk $100 per trade and set your stop loss 30 pips away, you might trade 1 lot. But in a more volatile market, if your stop loss is 90 pips away, you should reduce your trade size to 0.33 lots to maintain the same $100 risk level.

5. Use Trailing Stops to Lock in Profits

A trailing stop is an excellent tool for stop loss trading, especially in volatile markets. A trailing stop automatically moves with the market as it moves in your favor, locking in profits while protecting you from sudden reversals.

Example:

If the market is moving strongly in your direction, a trailing stop will follow the price, ensuring that some of your gains are secured even if the market pulls back unexpectedly. This is particularly useful when market conditions are volatile and unpredictable.

6. Stay Alert During News Events

News events like interest rate decisions or political announcements can cause extreme market volatility. During these times, regular stop loss trading strategies might not be enough. Either set wider stops or consider sitting out these events altogether to avoid being caught in erratic price movements.

Last Words

In volatile forex markets, the importance of stop loss trading cannot be overstated. It is a key tool for protecting your capital, enforcing discipline, and managing risk effectively. By understanding market volatility, using tools like the ATR, avoiding tight stops, and adjusting your position size, you can enhance your stop loss strategy. Trailing stops and awareness of news events will also give you an edge in handling unpredictable markets.

Remember, in trading, protecting your capital is just as important as making profits. A solid stop loss trading plan helps you avoid emotional decisions, limit losses, and confidently navigate both calm and volatile market conditions. Ultimately, this approach is essential for long-term success in forex trading.