Last updated on November 26th, 2024 at 04:05 pm

The economic calendar plays a crucial role in the world of forex trading. It serves as a valuable tool for traders to stay informed about upcoming economic events and announcements that can potentially impact the financial markets. By understanding and effectively utilizing the economic calendar, traders can make informed decisions, manage risks, and capitalize on market opportunities. This article will guide you on how to read the economic calendar and emphasize its importance in forex trading.

Understanding the Economic Calendar

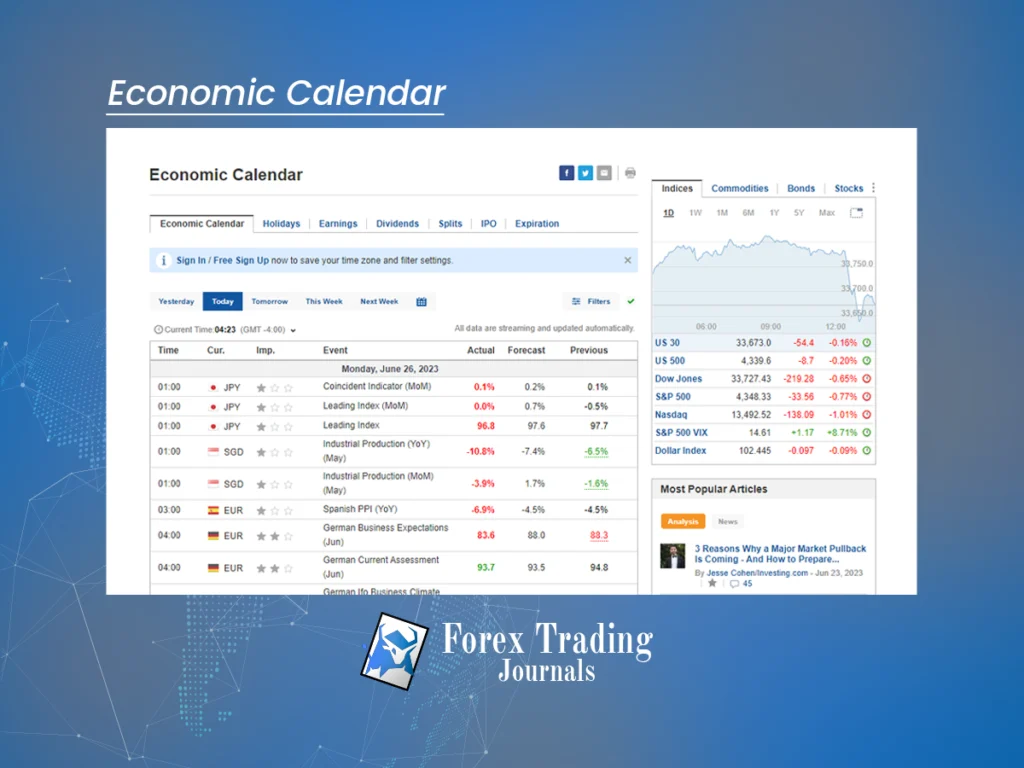

The economic calendar is a schedule of economic events, such as economic indicators, central bank meetings, and government reports, that are expected to be released in the future. It provides traders with a comprehensive overview of the upcoming economic data and announcements that can influence market sentiment and drive price movements.

Key Components of the Economic Calendar

Date and Time

Each event listed on the calendar is accompanied by its date and time of release. This information is crucial for traders to plan their trading activities and be prepared for potential market volatility.

Currency

The currency column indicates the currency pair that is likely to be affected by the specific event. It helps traders identify which currency pairs to focus on and analyze.

Event

The event column provides a brief description of the economic event or indicator that will be released. It can include indicators like GDP (Gross Domestic Product), CPI (Consumer Price Index), interest rate decisions, employment reports, and more.

Importance

Events in this calendar are usually categorized by their level of importance, often denoted by icons such as exclamation marks or stars. High-impact events are more likely to generate significant market movements compared to low-impact events.

Previous, Forecast, and Actual Data

This financial calendar also displays previous, forecast, and actual data for each event. Previous data represents the value of the economic indicator in the previous release, while forecast data is an estimation of what the market expects the indicator to be. The actual data reflects the actual value of the indicator when it is released. The comparison between forecasts and actual data can greatly influence market sentiment.

Why is the economic calendar important in forex trading?

Market Volatility

Economic events often trigger market volatility, leading to price fluctuations in the forex market. By keeping track of the calendar, traders can anticipate periods of increased volatility and adjust their trading strategies accordingly.

Fundamental Analysis

The calendar provides essential data for fundamental analysis. By analyzing economic indicators and their impact on currencies, traders can gain insights into the overall health of an economy and make informed trading decisions based on these fundamental factors.

Timing Trades

Timing is crucial in forex trading, and this financial events calendar helps traders identify optimal entry and exit points for their trades. By aligning their positions with important economic events, traders can take advantage of potential price movements and increase their profitability.

Managing Risks

The calendar allows traders to anticipate potential risks associated with economic events. By being aware of major announcements or central bank decisions, traders can adjust their risk management strategies, such as setting appropriate stop-loss levels or avoiding trading during highly volatile periods.

Tips for Reading the Economic Calendar

Focus on High-Impact Events

High-impact events have the greatest potential to influence markets. Focus on events marked as high importance on the calendar as they are more likely to create significant price movements.

Analyze Historical Data

Reviewing historical data can provide valuable insights into how specific economic indicators have affected the markets in the past. This analysis can help traders understand the relationship between economic events and price movements, aiding in more accurate predictions.

Consider Multiple Economic Calendars

It’s beneficial to consult multiple economic calendars to ensure comprehensive coverage of events. Different calendars may include additional events or provide varying interpretations, allowing traders to gain a more holistic understanding of the market.

Stay Updated

This financial market calendar is a dynamic tool that constantly updates with new information. Traders should regularly check for any changes, additions, or revisions to events to ensure they have the most up-to-date information for their trading decisions.

Conclusion

The economic calendar is an indispensable resource for forex traders, providing valuable insights into upcoming economic events and their potential impact on the financial markets. By mastering the art of reading and interpreting the this financial calendar, traders can enhance their trading strategies, make informed decisions, and navigate the dynamic world of forex trading with greater confidence.